texas estate tax limits

The Estate Tax is a tax on your right to transfer property at your death. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Emergency Snap Benefits Extended For January 2022 In Texas

The following proposed rule was filed with the Secretary of State on May 27 2022 and published in the Texas Register on June 10 2022.

. Under normal circumstances a new Texas law says a city cant raise property taxes more than 35 without voter approval but in disasters that trigger rises to 8. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual increases in property tax. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local. If the estate is worth less than 1000000 you dont need to. The limitation applies only to a residential homestead.

Meanwhile in Texas property appraisals have reached 10. It is offered for sale in the open market with a reasonable time for the seller to. The 30-day comment period begins when the rule is posted and ends July 10 2022.

Texass median income is. How much is the estate tax in texas. You must have filed for the homestead exemption.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Because both tax rates and property values fluctuate year to year property tax bills can be a scary unknown. The top estate tax rate is 20 percent exemption threshold.

If a taxing unit raises more than 8 of the property tax revenue of the previous year voters can file a petition. The 10 limitation is an annual limit to the assessed or taxable value and it dates from the latest reappraisal. You have the right to an election to limit a tax increase in certain circumstances.

Property -----property -property -96-. IRS Announces 2018 Estate And Gift Tax Limits. The current cap for the annual increase is 8.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. No estate tax or inheritance tax.

The estate and gift tax exemption is 117 million per individual up from 1158 million in. Just how much is too much is a matter of legal debate. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

Texas Property Tax Basics June 2020. You have the right to receive a free copy of the pamphlet entitled Property Taxpayer Remedies published by the Texas. There is no state property tax.

No Tax Due Threshold. Proposed Manual for the Appraisal of Agricultural Land. 93061 Installment Payments of Taxes on Property Not Directly Damaged.

Texas Department of Insurance. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

The market value of the property. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and. Market value is the price at which a property would transfer for cash or its equivalent under prevailing market conditions if.

Property Tax System Basics. Property taxes cant go up too much without voter approval. Property tax in Texas is a locally assessed and locally administered tax.

If that reappraisal occurred two years ago your new assessed value can exceed last years by 20. Tax Rate other than retail or wholesale 075. If youre responsible for the estate of someone who died you may need to file an estate tax return.

With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan. Is there a limit on how much property taxes can increase in Texas. Currently California only allows up to a 2 increase based on the value of the property.

Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation. Tax Rate retail or wholesale 0375. Ad Fisher Investments has 40 years of helping thousands of investors and their families.

Texas legislators have tried numerous ways to limit property tax growth.

Don T Die In Nebraska How The County Inheritance Tax Works

Texas Estate Planning Statutes With Commentary 2019 2021 Edition Paperback Walmart Com Estate Planning Estate Administration How To Plan

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

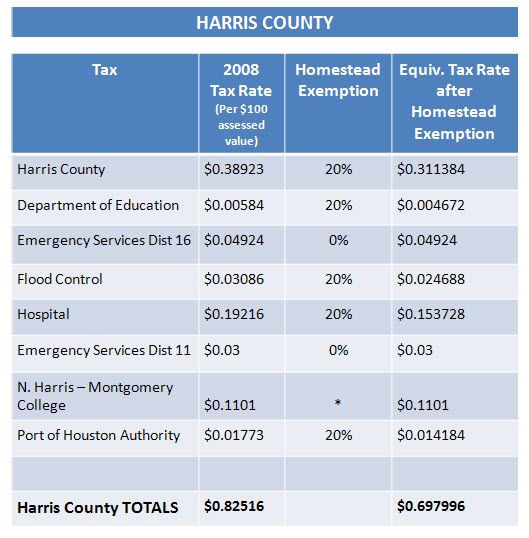

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

You Might Not Like A Particular Parent For Some Behavior He Or She Pursues The Same Might Be Your Concern With Respect To A Visitation Rights Tug Of War Tug

Why Are Texas Property Taxes So High Home Tax Solutions

Texas Estate Tax Everything You Need To Know Smartasset

What Is The Probate Process In Texas A Step By Step Guide

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Sales And Use Tax Rates Houston Org

Texas Inheritance And Estate Taxes Ibekwe Law

What Is A Homestead Exemption And How Does It Work Lendingtree

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Sample Power Of Attorney Form Free Printable Template Forms 2022 Power Of Attorney Form Power Of Attorney Real Estate Forms

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption